Plurality of media ownership and content are principal media policy values in European democracies. The issue has become even more topical than before because of the European Media Freedom Act (EMFA), which will be formally approved by the European Parliament and the Council later this spring. The regulation will be binding in its entirety and directly applicable in all Member States after 15 months.

EMFA will introduce a new set of rules to protect media – whether public or private, offline or online, print or broadcast – and their pluralism and independence in the European Union (EU).

The Act aims at protecting editorial independence, journalistic sources and functioning of public service media as well as enhancing transparency of media ownership, among other things. While also media concentration is one of the issues tackled by the new regulation, EMFA requires Member States to implement a constant assessment of the impact of key media market concentrations on media pluralism and editorial independence.

Indeed, this is needed in Finland. For example, the influential Media Pluralism Monitor (MPM), which assesses annually the health of media ecosystems in Europe, has repeatedly noticed that concentration of media ownership poses the greatest threat on media plurality in Finland.

*

Our research project Media concentration and diversity of media content in Finland was commissioned by the Prime Minister’s Office in January 2023. Focusing strictly on news media, we have examined the current state of the concentration of media ownership and its impact on media content.

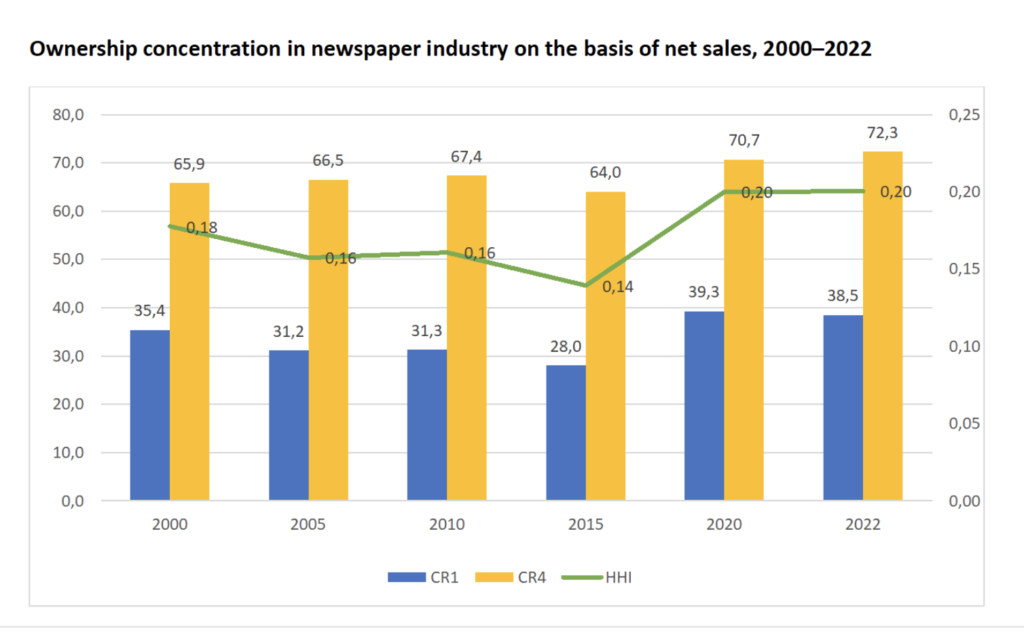

The analysis of media concentration covered the years 2000–2022 but, due to restrictions of data, was based on different variables for different media branches. As for the newspapers, we coded the circulations, net sales and the number of journalists for each newspaper and, then, combined the data on a per-owner basis. As for radio and television, shares of viewing or listening were used as a proxy of market shares, also combined on a per-media-company basis.

Our results show that the degree of concentration varies among media branches, and they have been partly developing in different directions in this regard. The radio and television sectors have evolved towards increased competition, while the earlier abundance of newspapers has decreased towards a more concentrated industry structure.

In the newspaper industry, the number of companies has been reduced by half from 117 to 61 between 2000 and 2022 reflecting the numerous company acquisitions made. Interestingly, concentration ratio, as measured with standard meters such as CR1 (market share of the biggest firm), CR4 (combined market share of the four biggest firms) or HHI (Herfindahl-Hirschman Index), was not dramatically changed. CR1 grew from 35 to 39 points, CR4 from 66 to 72, and HHI from 0,18 to 0,20, all scores for 2022 suggesting a highly concentrated industry, however. This observation received further confirmation from the analysis of the regional newspaper market, which showed that the average CR1 of the 19 regions of Finland had grown from 68 to 87 points. We even found regions with full newspaper monopolies.

In television, digitalisation multiplied the number of channels and players, resulting in more competition and less concentration. In 2000, there were no more than three players and six terrestrial TV channels in Finland, compared to 11 players and 40 channels in 2022. However, since 2005, CR4 has remained at a steady 90-to-92-point level, whereas HHI has decreased from 0,35 to 0,28, reflecting a more balanced distribution of viewing shares than before.

As for radio branch, the number of nationwide or semi-nationwide stations has grown from 15 to 29, whereas the number of players has varied between six and eight. CR4 has grown from 85 points in 2005 to 92 in 2022 while HHI has varied between 0,31 and 0,36.

Due to limited number of players, TV and radio broadcasting markets can be considered highly concentrated.

*

Earlier research on the impact of concentration on media content suggests that concentration provides wider shoulders and grants increased resources for producing quality media content, while increased cooperation within media groups tends to narrow down the news offer. Decreasing ownership diversity results in decreasing brand diversity, production diversity and content diversity.

The findings of our report support earlier results.

We investigated news overlap in newspapers belonging to the same group. Two of the analysed newspapers belonged to Sanoma group, two to Keskisuomalainen group and two to Kaleva group. Sanoma is the number one newspaper publisher in Finland and Keskisuomalainen number two while Kaleva is the major publisher in Northern Finland. Altogether 1,729 articles published during one week in April 2023 were analysed.

In Keskisuomalainen’s papers approximately one third and in Kaleva’s papers more than 40 per cent of the articles published were similar, whereas in Sanoma’s papers the overlap scored much lower, 11 to 12 per cent.

The results suggest that different newspaper groups have differing practices of sharing their content. While the Finnish News Agency STT was quantitatively the main source of common material for the papers of Keskisuomalainen and Kaleva, these papers benefitted greatly from joint political news, interviews, feature and lifestyle articles provided by their corporate newsrooms. Sanoma’s newspapers showed a different profile since they shared individual stories only, mostly produced by Helsingin Sanomat newsroom or regular freelancers.

Based on our survey (n = 61) and a series of thematic interviews (n = 8) we conducted among editors-in-chief, content sharing has increased and newspaper groups deliberately aim at encouraging cooperation between their newsrooms. Views on whether this has a negative or positive impact on contents were divided in the survey. 43 per cent were of the opinion that sharing improves news media content while 42 per cent were of the opposite opinion. However, a clear majority, 80 per cent, said that concentration threatens pluralism of voices in the media and 62 per cent said that content sharing has the same effect.

*

In the post-EMFA world, Member States will be required to assess continuously the state and plurality of their news media industry and consequences of its consolidation and increased concentration on newsrooms. Our study discusses possible approaches which can be applied in the assessments while also providing concrete measures and results which can be useful for the implementation of the Act.

HEIKKI HELLMAN